oklahoma sales tax car purchase

If used to finance roads and. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Chapter 60 Motor Vehicles Oklahoma Tax Commission State Of

Standard vehicle excise tax is assessed as follows.

. Senate Bill 1619 authored by Sen. As of July 1 2017 Oklahoma charges a 125 percent sales tax on vehicle purchases in addition to motor vehicle taxes. The make model and year of your vehicle.

Typically the tax is determined by. Advantages of the motor vehicle tax are. Used vehicles are taxed a flat fee of 20 on.

Darcy Jech R-Kingfisher would. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Oklahoma charges two taxes for the purchase of new motor vehicles.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car. For example here is how much you.

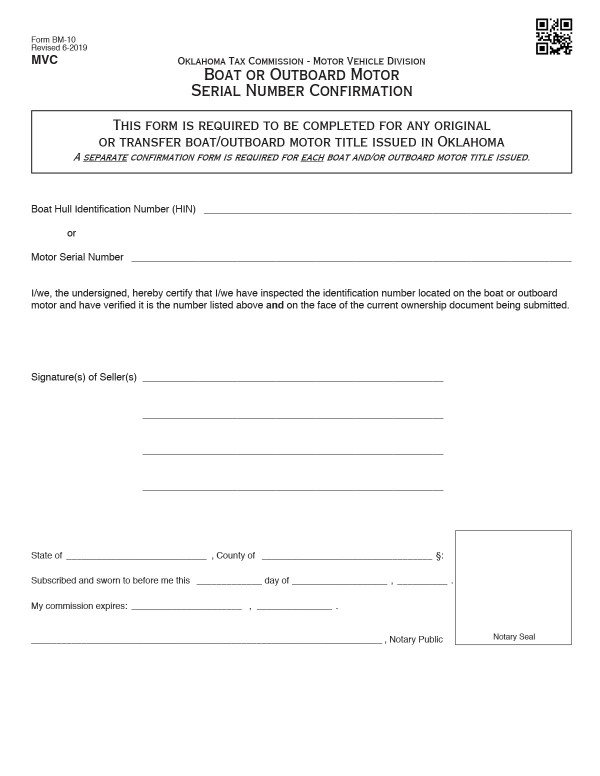

This form may also be. The vehicle identification number VIN. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in.

Oklahoma Tax Commission - Motor Vehicle Division Declaration of Vehicle Purchase Price This form is for the purpose of establishing the purchase price of a vehicle. Typically the tax is determined by. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle.

125 sales tax and 325 excise tax for a total 45 tax rate. The title and registration process is. The excise tax is 3 ¼ percent of the value of a new vehicle.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. An average value for all such model vehicles is utilized. The information you may need to enter into the tax and tag calculators may include.

Oklahoma charges 45 percent state sales tax on sales of tangible personal property and certain services. The date that you. Just visit your local tag office with the manufacturers certificate of origin or the current title signed over to you the bill of sale and proof of insurance.

In Oklahoma the excise tax is. The value of a vehicle is its. 325 of the purchase price or taxable value if different Used.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Find sales tax rates in Oklahoma by address or ZIP code with the free Oklahoma sales tax calculator from SalesTaxHandbook. The sales tax is paid by the buyer and collected and remitted by the seller to the Oklahoma Tax Commission42.

Motor Vehicle Excise Tax Purchase Types New Vehicle. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. The state also has some special taxes and levies discretionary taxes local sales and.

Car Sales Tax In Oklahoma Getjerry Com

Sell Your Car In Oklahoma Cash For Cars Up To 14 900 The Clunker Junker

Paperwork Required When Buying A Car In Oklahoma Vinfreecheck

Sales Tax Laws By State Ultimate Guide For Business Owners

Oklahoma Bill Of Sale Vehicle Fill Out Sign Online Dochub

Oklahoma Senate Passes Bills To Modify Vehicle Sales Tax Registrations Kokh

Oklahoma Vehicle Registration And Title Information Vincheck Info

Used Cars For Sale In Oklahoma City Ok Cars Com

What S The Car Sales Tax In Each State Find The Best Car Price

Used Cars In Oklahoma For Sale Enterprise Car Sales

Sales Taxes In The United States Wikipedia

Oklahoma Tax Commission Oktaxcommission Twitter

John Holt Chevrolet Your Chevy Dealer In Ok

Oklahoma Senate Passes Bills To Modify Vehicle Sales Tax Registrations Kokh

Starting July 1 Oklahoma Drivers Will Keep License Plates When Selling Vehicles

Nj Car Sales Tax Everything You Need To Know

Used 2019 Buick Encore For Sale In Oklahoma City Ok With Photos Cargurus